Having an excellent credit score can empower you in many ways. As long as you use your good credit responsibly and don’t take on high-interest debt, having a good credit score is critical to a healthy financial portfolio.

Your credit score is calculated based on the total credit and debts you have outstanding. A higher score is better and makes it easier to get credit/loans and more favorable terms.

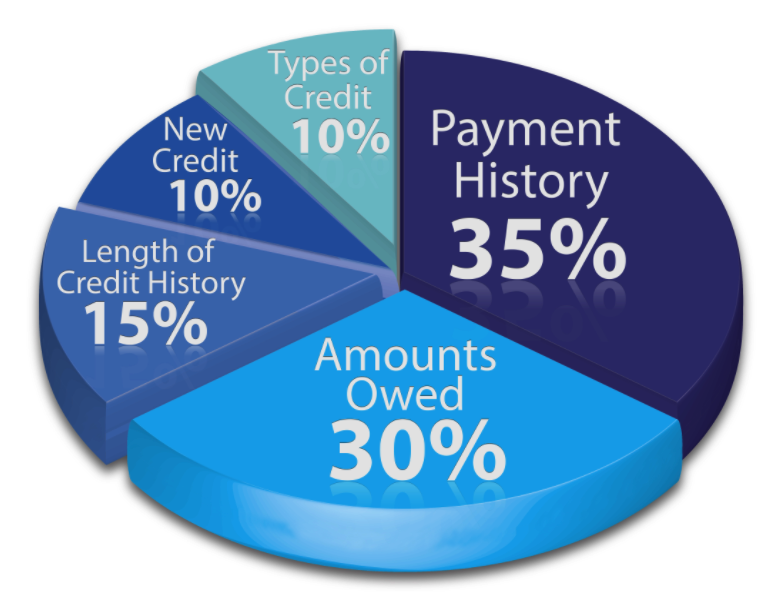

Factors That Go Into Calculating Your Credit Score:

- The number of loans and lines of credit you have outstanding and the total amounts owed.

- Any missed or late payments.

- Evidence that you are paying down your debt

- Your income, and the percentage of your income that goes into monthly debt payments

- The amount of time you have had a credit history

- Your credit ratio the amount of total credit you have divided by the actual credit you are using.

- Credit inquiries, too many inquiries in a short time by potential lenders can lower your score, as it might indicate that you are seeking too much credit. Every time you apply for credit, a “hard inquiry” is made and recorded, which can count against you.

Things You Can Do To Build/Improve Your Credit:

- Pay all bills on time. As you can see above, payment history accounts for 35% of your credit score.

- Reduce total monthly debt payments to 30% of income or less, including mortgage, line of credit, credit cards, student loans, etc. Total debt owed accounts for 30% of your credit score.

- Have one or two credit cards with minimal, if any, debt, and slowly increase the limits over time.

- Don’t apply for new credit in multiple places in a short time; ideally, space them out at least six months apart. New credit accounts for 10% of your credit score.

- Pay down debt and keep balances low.

- Don’t “max out” credit cards. If you carry a balance on a card, keep it below 30% of the total credit allowed on that card.

- Get your score to >750 to get optimal terms on loans.

- Don’t have more credit than you need. It might tempt you to spend, and if someone steals your card/identity, the potential loss is much more significant.

By making some positive credit moves, as suggested above, you will start to see an improvement in your credit score within four to six months.

Periodically checking your credit score is a good idea. Checking your score is considered a “soft inquiry,” and you will not negatively affect your score.

Check Your Credit – It’s Free!