Budgeting your money is a great way to control your spending and help you reach your financial goals. If you have never budgeted before, a great way to get started is with the 80/20 rule.

What is the 80/20 Rule?

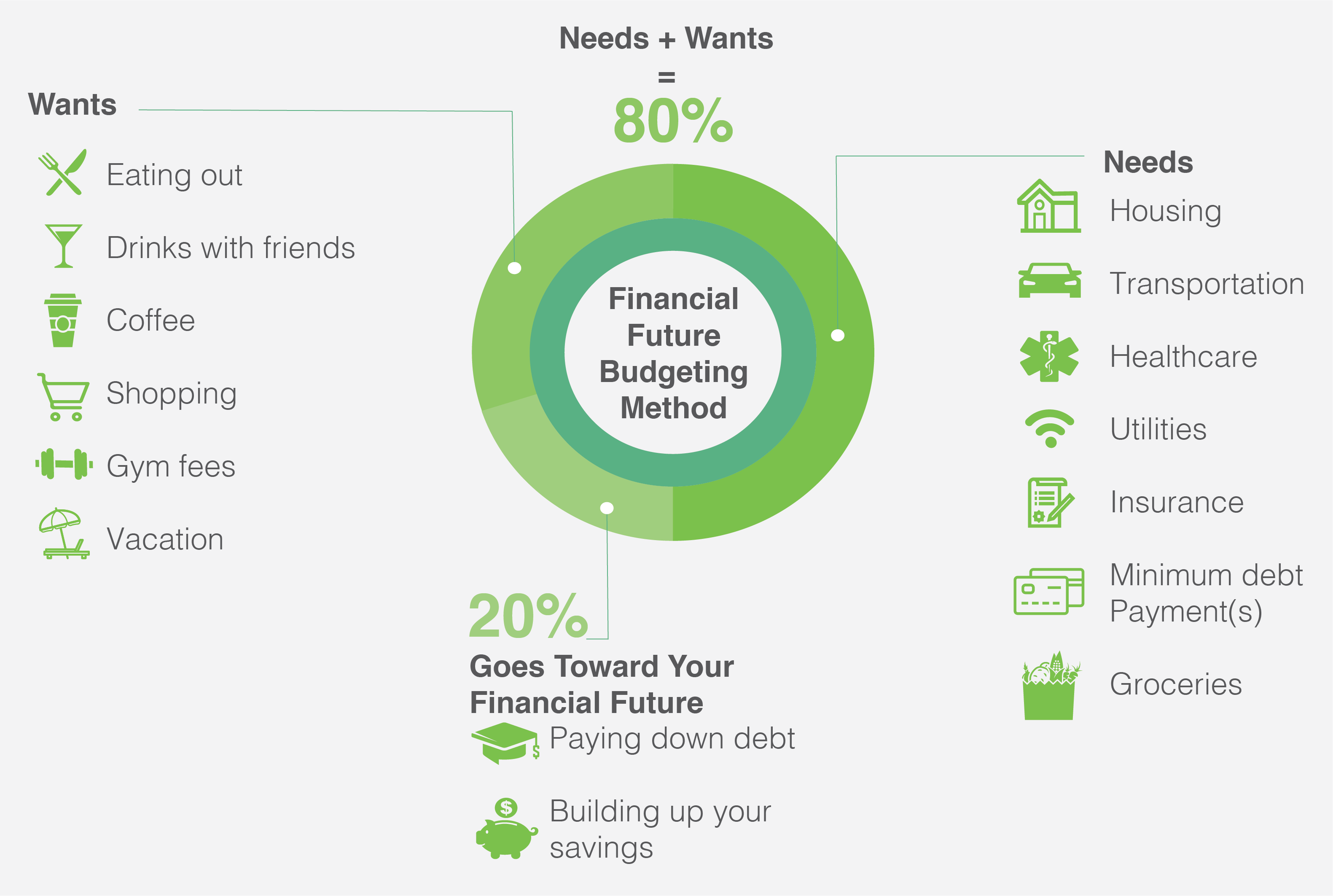

Divide your monthly, after-tax, income accordingly. 80% of your budget should be spent on your needs and wants. The other 20% goes toward your financial future. These are items such as paying down debt, savings, retirement, and investments.

The best way to budget is to put money toward your financial future first. Allocate the funds you want to have available for your future self, the money you are setting aside now to make sure you are ahead in the future. After you have allocated funds to your financial future, you tackle the items that are your needs. These are the critical items you have to pay each month. Needs include minimum payments on loans, credit cards, medical and dental insurance, rent or mortgage, etc.

Once you have taken care of paying yourself first and covering your needs, what you have left in the budget is available to spend on wants.

Make sure to write down your plan and keep track of it to ensure that you are achieving your goals. As you become more comfortable with your budget, you will be able to see areas to save, and you will be able to increase your savings and investment in your future.