We surveyed over 26,000 full-time working adults who have employer-sponsored health care coverage, and over 20% were currently delaying medical or dental care because of the cost. Taking control of your finances shouldn’t mean the choice of being healthy or unhealthy. But unfortunately, for one out of every five insured adults surveyed, it does.

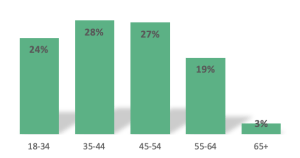

Age and gender didn’t have an impact either; being unable to afford medical and dental care affected all ages groups and genders. Of our surveyed population who responded “yes” to delaying medical care were the following ages:

Surveyed Population’s Age

Health care costs are skyrocketing for employers. In an attempt to control these expenses, more of the costs are understandably being passed on to employees/patients. We know that people are delaying and deferring care and procedures due to the increasing costs of copays and deductibles.

As MoneyWellth’s Chief Strategy Officer, David Ashley, noted, “When care gets delayed, it often leads to worse problems and higher costs down the road. It makes sense. Delaying diagnosis and treatment of diabetes, hypertension, heart disease, and other common disease states are dangerous and can lead to worse outcomes for individuals. High copays on screening procedures, like mammograms and colonoscopies, force a lot of people to put them off. By putting off critical preventive screenings, it can lead to delayed diagnosis of breast and colon cancer, as examples. Cancers and other diseases are always easier to treat and more likely to be cured when identified early”.

Delaying diagnosis for diseases causes increased morbidity and mortality for a population. It is devastating to an individual when diagnosis and treatment are put off. It increases costs for the health care system as a whole and the employer who is providing insurance to employees.

{ Not only do health care costs go up, but days lost of work and decreased productivity are factors when people delay or put off health care. }

People put off care for many reasons, such as difficulty finding a primary care doctor, inconvenient office hours, and not prioritizing health care. As employers, you can’t control those variables. However, when care is put off due to a perceived lack of affordability, that can and should be addressed with financial education.

Employees who don’t have savings to cover for these types of expenses must review their money habits. If available, it’s a great idea to take advantage of Health Savings Accounts (HSA)s or Health Reimbursement Accounts (HRA)s. They should also have an “emergency fund” set aside for unexpected expenses, medical or otherwise. Copays for preventive visits and screening procedures aren’t unforeseen or unknown expenses, but may not be part of people’s normal budgets.

Financial wellness programs in the United States have to consider the very real consequence that our health system doesn’t always cover necessary medical expenses. Even with employer-sponsored healthcare, many participants can’t afford the deductibles and out-of-pocket expenses that are required for necessary medical care. Supporting participants on a path to financial freedom can often mean enabling them to receive the medical and dental care they need.