The gross national debt of the United States just surpassed $30 trillion. The big question is, do we need to be worried? The answer is: yes, maybe? Now, let’s break down why it should be on your radar.

Just like personal debt, we as a country must pay interest on the money we borrow. As the debt grows larger and larger, so does the interest on the debt. The US is paying about $500 billion (1/2 trillion) annually for interest on our debt. Interest rates are very low currently. If rates moved up to their historic average, 4-5% on the 10-year treasury bond, the annual interest we would have to pay on that debt could double or triple to over $1trillion.

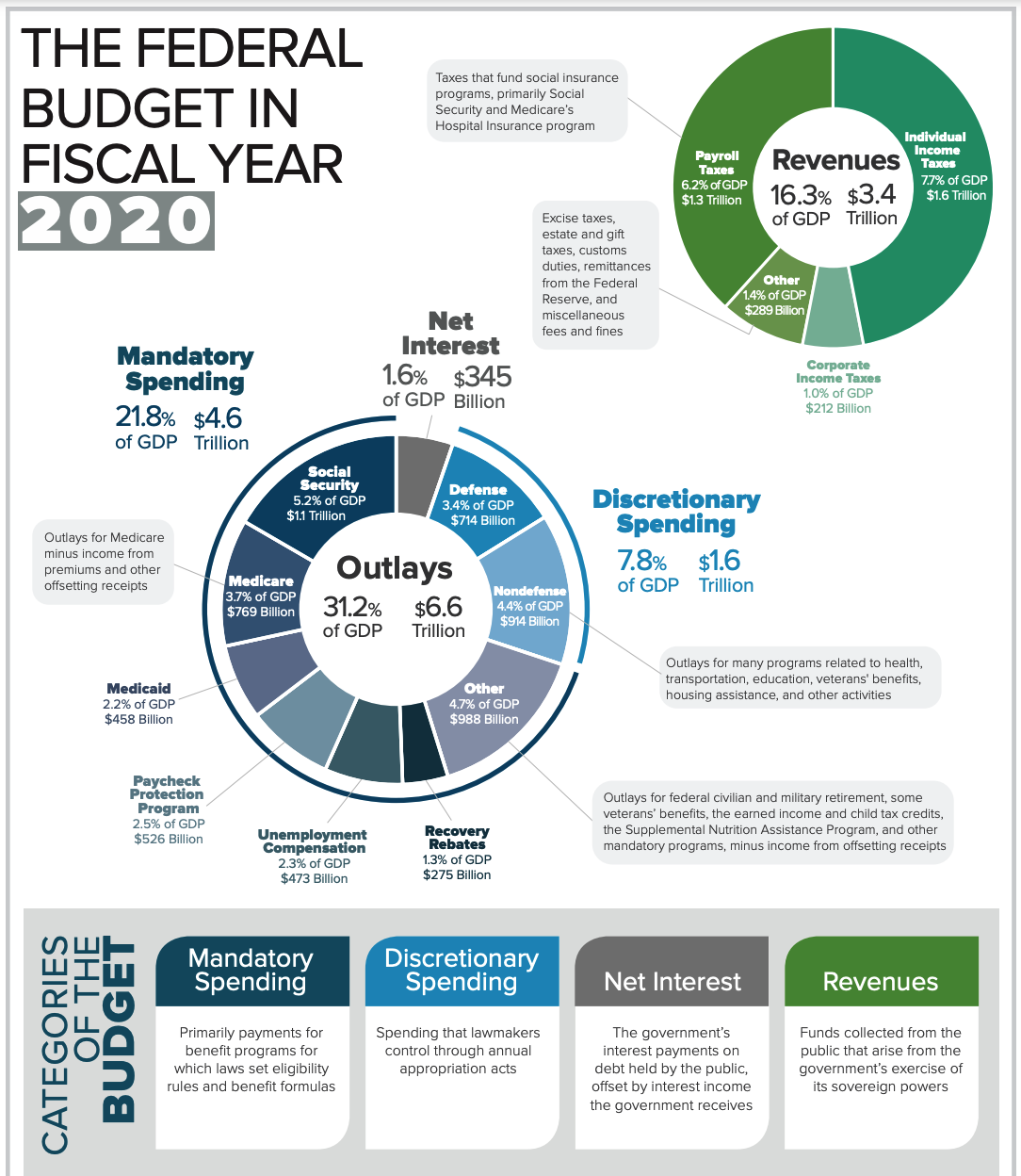

The chart below was constructed by the US Bureau of Labor Statistics (BLS). This was for the year 2020 and show the breakdown of our countries spending vs income (tax money from citizens). If you look at the green “Revenues” pie chart in the upper right, this shows the U.S brought $3.4 trillion in taxes/revenue for 2020. Now look at the blue/black “Outlays” pie chart, we spent $6.6 trillion that year, about $3 trillion more than we brought in in taxes.

Prepared by Christine Bogusz, Dan Ready, and Jorge Salazar Source: Congressional Budget Oce, April 2021

Prepared by Christine Bogusz, Dan Ready, and Jorge Salazar Source: Congressional Budget Oce, April 2021

The important thing to notice on this chart is how much of those outlays are “mandatory spending”. Things like social security, Medicare, military and government pensions. These are expenses that are locked in and would require a change in laws to change them. We spent $4.6 trillion on those expenses. “Discretionary” spending is the spending that congress has control over and votes on with the annual budget. That is $1.6 trillion.

So, if interest rates increase, if the U.S. has to pay up to $1 trillion more annually, just to cover interest on the debt, where will that money come from. Do we drop some discretionary spending so that we can pay off the debt? Do we change laws in order to decrease Medicare or Social Security funding? Any of those choices would be hard for the public to swallow and put a lot of peoples’ futures at risk. The easiest choice is to just keep adding to the debt.

There are economists in and out of the government who would say that the debt increase is not a problem. As long as the economy is growing, low interest rates persist, and investors from around the world buy US treasuries to fund the debt, then we will be fine. These economic leaders say that since the dollar is the world’s reserve currency, there is a huge market for the dollar itself. A recent New York Times article on the subject summarized recent comments from Treasury Secretary Janet Yellen, “Yellen has argued that such large federal investments are affordable because interest costs as a share of gross domestic product are at historically low levels thanks to persistently low interest rates.”

A few conditions need to persist in order our $30 trillion debt to not be a problem:

- interest rates must stay low, currently below historical norms

- the economy must keep growing, so no room for a recession

- the rest of the world keeps investing in the dollar, and US treasuries.

If the U.S. keeps adding to debt, then the amount we have to pay toward the interest on that debt will go up every year. At some point, that debt matters. There are a few worrisome potential consequences of increasing debt and interest payments on debt, which include:

- higher inflation

- fewer government services

- cuts in Medicare and Social Security

- loss of US dollar world reserve currency status

Debt does matter and the higher it goes the more it matters. Being aware of the potential consequences can help any saver and investor plan better for their future.