When you are thinking about getting healthy, the prescription for good health is straightforward. The core principles include eating right, staying active, and not smoking. When it comes to your finances and financial wellness, what’s the prescription to financial success?

Though financial wellness is quickly becoming a core component of a comprehensive wellness program, it doesn’t carry the same straightforward prescription to success. Financial success is achievable in many ways, and it doesn’t look the same for everyone.

At MoneyWellth we have identified core tenants to look at within your financial portfolio:

What a healthy financial portfolio looks like for one person could look very different for another. It’s important to allow participants to set money goals and then teach them how to achieve their specific goals from a comprehensive perspective. It’s also important to recognize that not everyone’s financial journey or appetite for taking risk is the same.

Here are two examples of people’s journey to financial success:

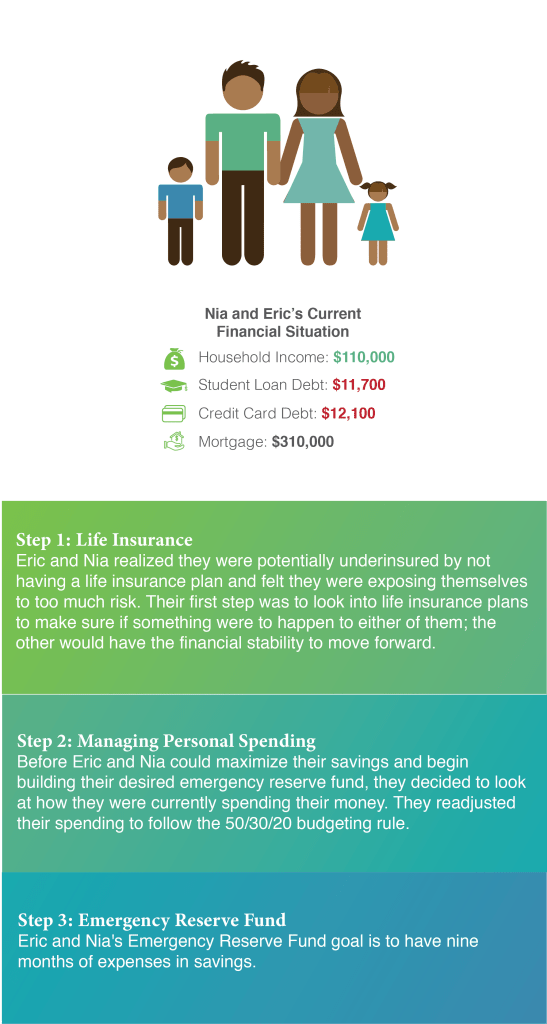

Example 1

Nia, 37 and Eric, 39

Nia and Eric are married and have two kids, Lucas, 7, and Zahra, 4. With two young kids around the house, they are always on the go. Nia recently decided to become a stay at home mom while Eric is a construction project manager. They have a combined household income of $110,000 and own their home. They are in $11,700 of student loan debt and $12,100 of credit card debt. They also have a $310,000 mortgage. They started accumulating more credit card debt after they had their kids and were eager to begin taking control of their finances.

Nia and Eric’s Financial Journey

Nia and Eric’s Next Steps:

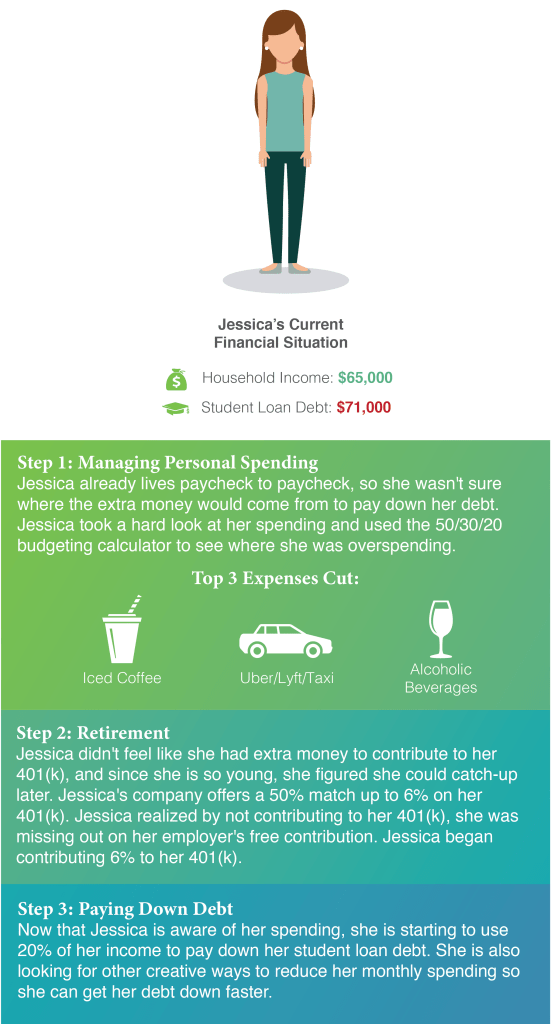

Example 2

Jessica, 29

Jessica recently turned 29, and the idea of turning 30 next year made her anxious to get her finances in order. Jessica is a marketing specialist who loves her job and city life. Sunday Brunch and Yoga are easily her favorite activities. Jessica’s household income is $65,000, and she currently rents her apartment with her roommate in downtown Boston. Jessica has $71,000 in student loan debt.

Jessica’s Financial Journey

Jessica’s Next Steps:

At MoneyWellth, we realized that each person or household has different financial goals and different paths to financial success. Our purpose is to educate participants on the core tenants of finances to empower them to start their journey to financial success.