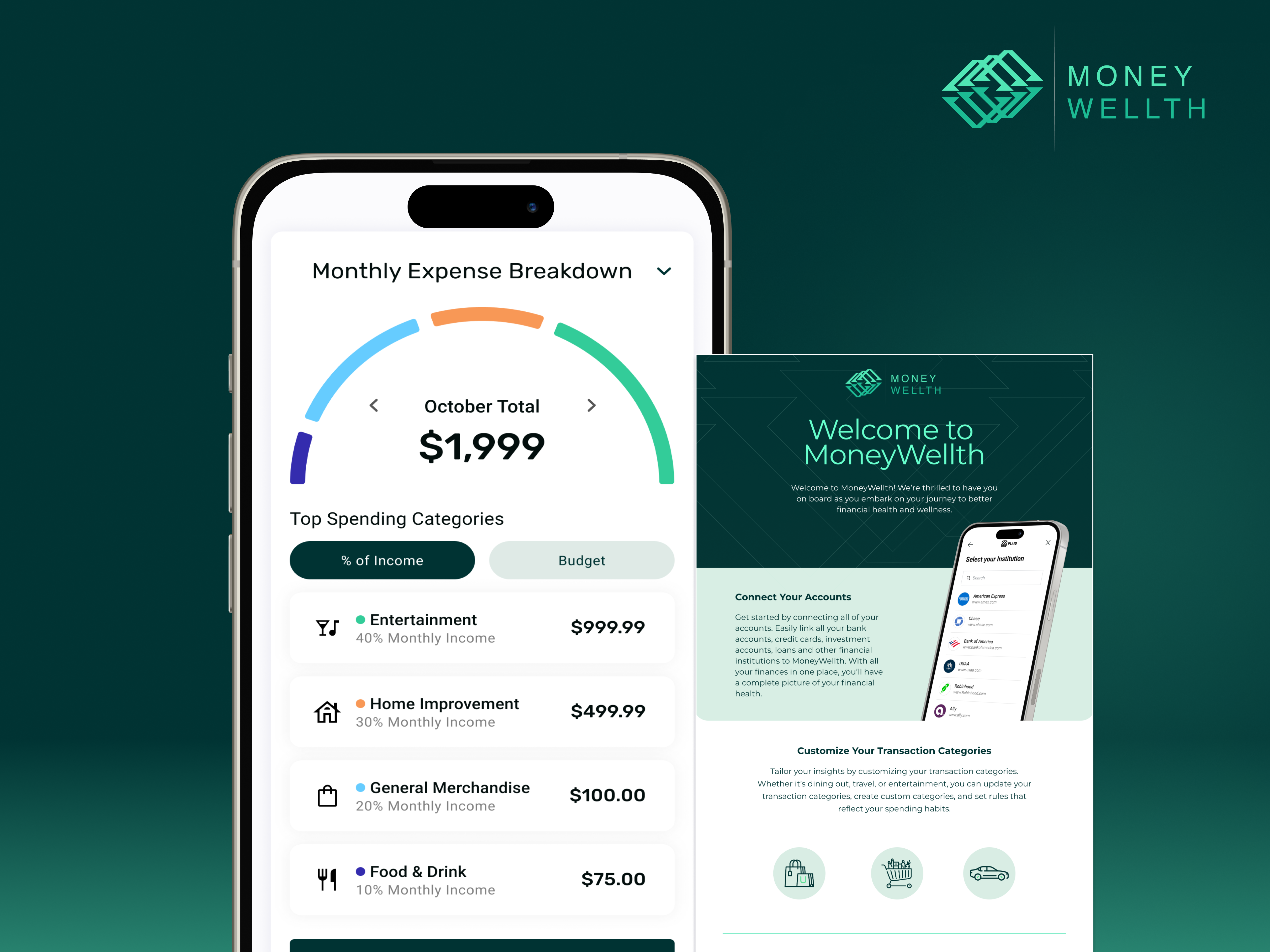

Supporting Employees with a Financial Wellness Benefit

Financial wellness transcends the simplicity of receiving a regular paycheck. It envelops the comprehension and effective management of one’s financial resources, enabling individuals to meet their life aspirations, address sudden financial burdens, and attain a sense of financial security. In today’s intricate economic environment, individuals face a myriad of financial challenges, making it paramount for … Supporting Employees with a Financial Wellness Benefit